Configuring Cost of Goods Sold for Procedures

Since procedures might have a supply product AND a cost per visit, these are a little more complex to configure and use than product COGS.

An example would be an Apeele.

| $150.00 | Charge to Patient | |

| less | $50.00 | Product Cost for Peel |

| less | $5.00 | Consumables |

| equals | $95.00 | Gross Profit |

Consumables are supplies in your office that are not individually tracked, e.g. backbar cleanser, applicators, gauze pads, etc. (Most practices calculate an average cost for each type of visit.)

In order to configure and track cost of procedures sold, you will need to create products for the actual products and consumables for each procedure and then attach these products to the applicable procedure. Then, you will need to run a COGS report and a sales report to get your gross profit.

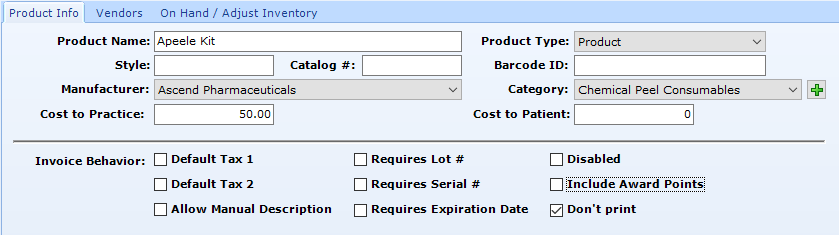

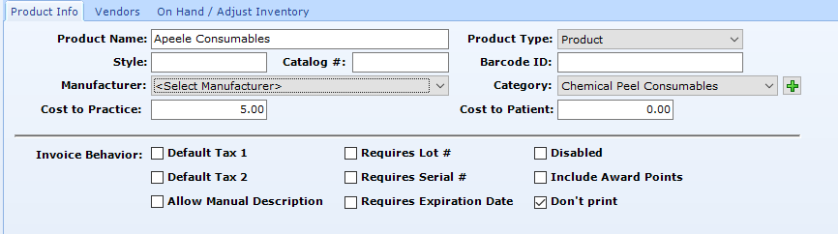

Configure Products

Navigate to Back Office | Inventory, Products tab.

Add the 2 products below.

- Cost to Practice. Your cost for the product.

- Cost to Patient. Should be $0.

- Don't Print. Should be checked.

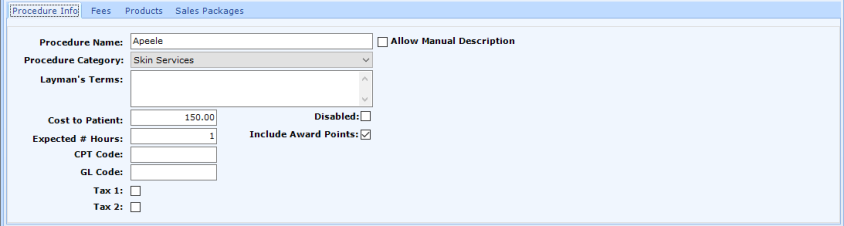

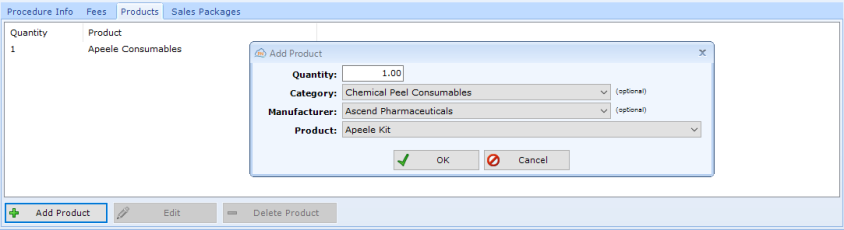

Configure Procedure

Navigate to Administration | Financial Admin, Procedures Tab.

Select Procedure in upper window (or Add), then add the product(s) configured above to the procedure.

Don't forget to Save Modifications.

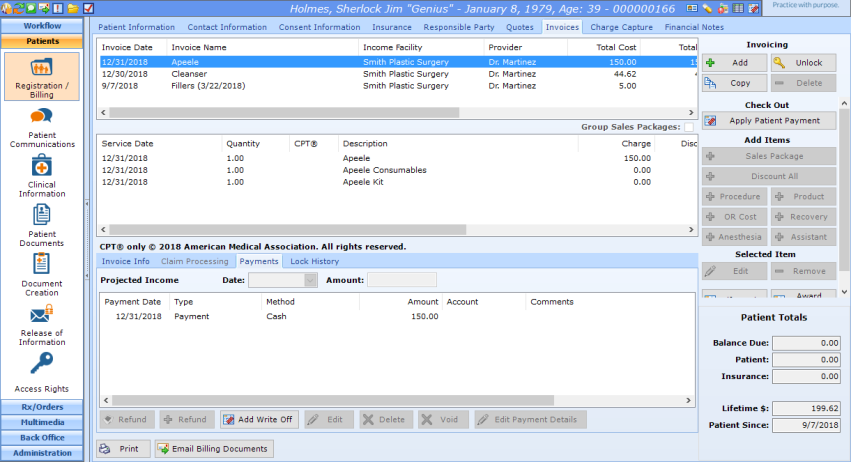

Sell a Procedure with Products Attached

Select patient and navigate to Patients | Registration/Billing, Invoices tab.

Add Immediate Sale Invoice.

Add Procedure. The products you added to the procedure will show on the invoice in patientNOW (but will not print on the invoice you give to the patient).

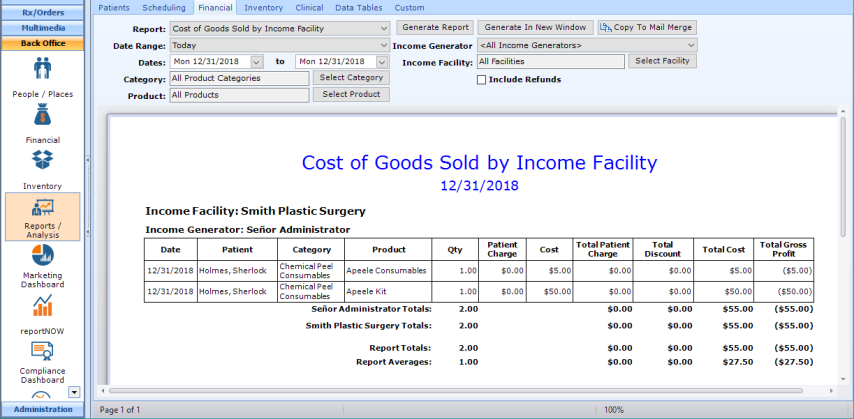

Run COGS Report

Navigate to Reports (at top of screen) | Financial, Cost of Goods Sold by Income Facility report.

Run Procedure Sales Report

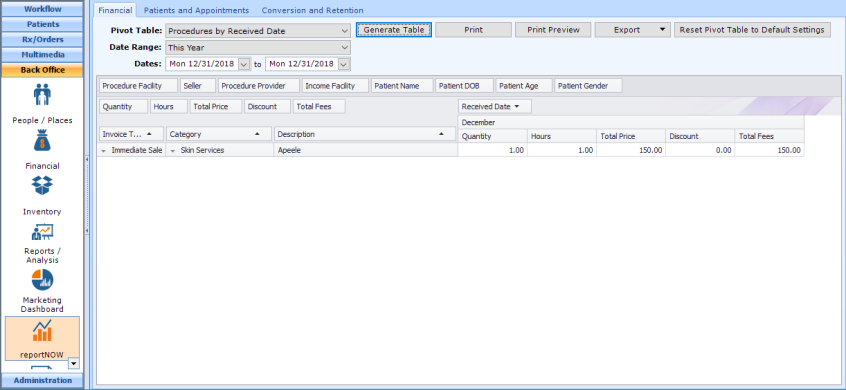

Navigate to Back Office | reportNOW, Financial Tab - Procedures by Received Date.

Combine these numbers with your COGS report above to get a Gross Profit.